Once you’ve registered your phone and the account number to which you want to receive funds, the bank will issue you an MMID number. An MMID Code and your mobile number are required for IMPS transfers. Let’s get into the details.

What is MMID

The MMID, or Mobile Money Identifier, is a seven-digit number issued by the bank to the customer upon registration for the Immediate Payment Service (IMPS). To make a payment via IMPS, customers can either use their registered cellphone number or send an SMS from the same.

Using the mobile banking platform, you can send money between banks using the MMID code. The MMID service was originally introduced in India in 2010 as a replacement for the RTGS and NEFT services, which were two of the most popular methods of transferring funds in the country at the time.

How Does MMID Work

Let’s take a closer look at how MMID actually works. Firstly, both the sender and the recipient must have a Mobile Money Identifier before an interbank fund transfer (NEFT/RTGS), including a mobile number, can be completed.

When a consumer uses the Immediate Payment Service to send or receive money, they must have their MMID number handy. For every bank account, there is only one MMID number. Dissimilar MMIDs can be linked to the same mobile number.

Online money transfer service Immediate Payment Service (IMPS) is supplied by any bank to its customers. As of 2010, IMPS has been in operation. With IMPS, a consumer can send money in real-time. In order to send money via IMPS, the most common method is to use a bank account number and an IFSC code. It is possible to use IMPS to transfer money from any bank account to any bank account holder.

Readmore: What Are the Differences between IMPS and NEFT

Why is MMID Required

Net banking services like RTGS and NEFT, which allow for rapid money transactions, are not available to many people across the country. However, the vast majority of individuals own smartphones.

Thus, the MMID helps to avoid financial fraud. It’s simple to use, and it speeds up digital data transmissions. Banking has undergone a radical change as a result of this value proposition.

People who do not have online banking can still benefit from this because of the introduction of MMID. There is no need for bank account numbers or IFSC codes for both senders and receivers. MMID can be used to receive money transfers if you have a mobile number associated with your bank account.

How to Generate MMID

You should also know how to generate your MMID code, in addition to knowing what MMID is. There are a variety of ways to go about writing the code. The following are their names:

- When you sign up for mobile banking, you’ll receive a welcome package, including an MMID generator.

- You can generate your MMID by going to your bank and filling out a form. A 7-digit MMID code is issued to you once you have registered your mobile number with your bank.

- Request through SMS if your bank provides this service.

- Using a phone banking system. To use phone banking, dial the designated number. Your MMID will be generated by a customer service agent. Within 24 hours of registering, you will receive an MMID on your registered cellphone number.

- Logging into your net banking account and finding the ‘Generate MMID’ area should do the trick. Verify that you’ve entered all of the relevant information. You’ll be given an MMID for the appropriate account.

- Under the IMPS fund transfer tab in the mobile banking app. After successfully registering, you will receive a 7-digit MMID code by text message to your registered mobile phone number.

MMID is a very user-friendly technique for bank transactions. For people who don’t have access to digital banking, it’s a great way to send and receive money.

There are three ways to create an MMID:

- Mobile Banking

- Internet Banking

- Phone Banking

1. Mobile Banking

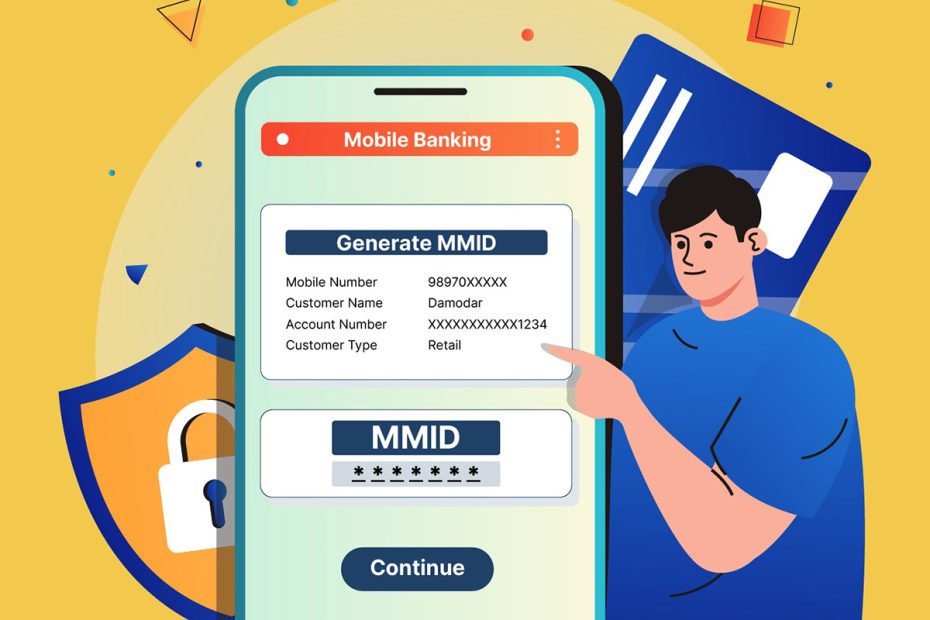

- Go to the ‘Account’ option in your bank’s mobile banking app.

- Choose “Generate MMID” and click on it to begin the process.

2. Internet/Net Banking

- “Generate MMID ” is available on the main page.

- In order to access the bank’s online banking system, you must enter all of your login information.

- If all the necessary information is submitted and verified, the MMID will be generated for the correct account.

3. Phone Banking

- Dial the bank’s phone banking number

- Select the suitable language and banking alternative.

- In order to get your MMID within 24 hours, you’ll need to contact a customer care agent and request it.

How to Get an MMID number

Having established the significance of MMID, the next step is to discover how to obtain an MMID number. An active mobile banking service from your financial institution is required to use IMPS. As part of the process, you’ll need to give the bank your phone number, known as the “registered mobile number,” or RMN.

To make use of this service, go to your bank and fill out an application. To conduct an instant fund transfer, you’ll need to provide your bank with your phone number and receive a seven-digit MMID code.

How to Use MMID for a Fund Transfer

To use MMID for money transfers, follow these instructions:

Step 1: Begin by logging in to your mobile banking application.

Step 2: Tap on the IMPS tab under the fund transfer area.

Step 3: Start the transfer by entering the recipient’s mobile number and MMID code.

Step 4: Use an OTP or PIN to authenticate the transaction.

Step 5: The money will be deducted from your bank and credited to the recipient’s account as soon as the transaction is verified. Once the transaction is complete, an SMS will be sent to both you and the recipient.

Your bank’s official website can be used to add beneficiaries and initiate IMPS transfers, as previously stated. It’s easy to transfer money via IMPS if you have the recipient’s MMID code and cell phone number.

Benefits of MMID

- People are increasingly willing to accept online payment methods now that we live in a digital age. Payment systems like NEFT, RTGS, and IMPS have grown in popularity as a result of online transactions. Because of the restrictions of NEFT and RTGS, many users opt out of using them in favour of IMPS, which is far more useful and convenient.

- The main advantage of MMID is that anyone with a bank account can use it to transfer money rapidly. For instant payments, an MMID code enables the entire IMPS payment system. The ability to send money and have it received by another party in real-time is a valuable feature that appeals to almost everyone.

- Additionally, the MMID Code eliminates the need for a bank account holder to divulge their account number & IFSC code to an unknown third party, reducing the risk of fraud and theft.

- As a result of the MMID code, a bank account holder can easily transfer funds between accounts. For bank account holders, it saves a great deal of time and work while also changing the way conventional banking is done.

Final Word

Now that you’ve learned the meaning and applications of MMID, you may easily take advantage of this service. The federal government has simplified money transfers as a result of MMID.

When it comes to digital banking, MMID codes have reshaped the landscape, allowing everyone in the country to transfer money. It has made banking more convenient for customers and altered the way it was done in the past.